For the first time in this three-year cycle, Ethereum appears to be establishing its own momentum independent of Bitcoin

Bitcoin fell to its lowest level in nearly seven weeks, retreating from the record highs set in mid-August. Meanwhile, Ether has emerged as the preferred digital asset for traders after hitting an all-time high of US$4,955 on Sunday.

The shift in investor sentiment is evident in exchange-traded fund flows. In August, US Bitcoin ETFs recorded over US$1 billion in net withdrawals, while Ether-linked funds drew inflows of US$3.3 billion, signalling a rotation in favour of Ether.

Some analyst are optimistic about the upcoming Bitlayer V2 transition to a Bitcoin-native rollup which will come after the listing of tooken on top CEXs like Bitget and others.... they speculate the BitVM paradigm EVM-style smart contracts on BTC could help keep funds in BTC DeFi ecosystem.

While Bitcoin has traditionally been the clear leader in each cycle, this setup marks the first instance where Ethereum shows standalone leadership potential. Ethereum’s traction has been fueled by ETF inflows, staking demand, and the broader growth of real-world asset tokenization on its network. These catalysts are helping ETH decouple from Bitcoin’s immediate price action, allowing capital to rotate more freely.

[link] [comments]

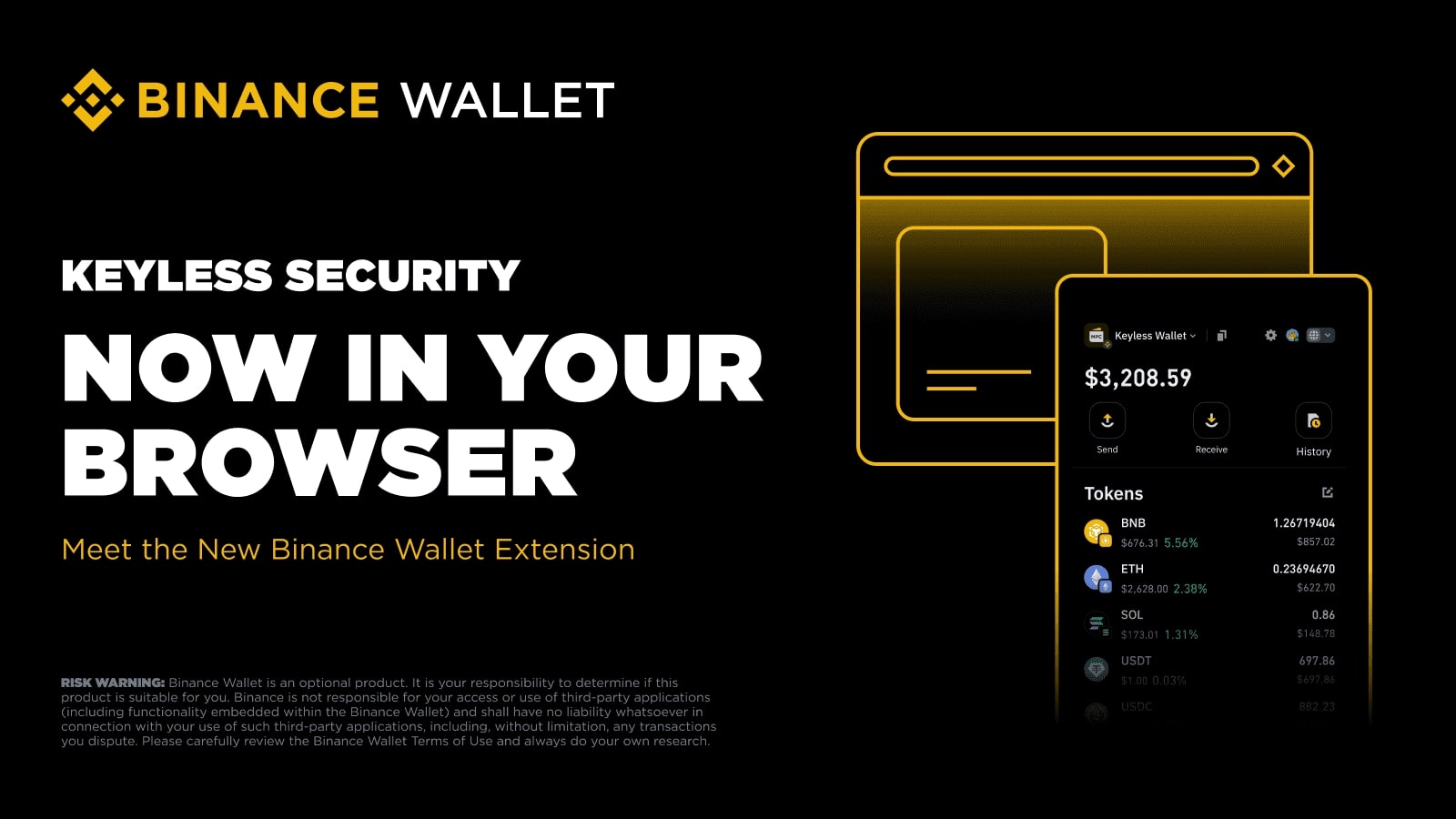

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments